India has also become an attractive growth market for many Western companies: If companies have their business presence in India and operate on regulated financial markets at the same time, they are obliged to apply for an LEI number in India by the requirements of India’s central bank, the Reserve Bank of India. Due to the geographical, cultural and language barriers, this application can sometimes be a challenge, at least for newcomers to the market, especially as the LEI number also needs to be renewed annually. For those needing to obtain an LEI in India, a structured approach to LEI Number Registration is essential to ensure compliance with regulatory requirements and avoid potential delays.

When must an LEI number be applied for in India?

LEI, short for “Legal Entity Identifier,” is a standardized system introduced in the wake of the 2008 financial market crisis. Numerous countries participate globally, including the Euro region, the UK, the USA, and India. The RBI introduced and enforced the regulations in 2017, with the central bank also defining the specifications.

The 20-digit alphanumeric identifier, which is subject to the ISO 17442:2012 standard, is a necessity under these conditions:

- if legal entities (i.e. companies) wish to participate in the financial market and use financial market instruments in the course of doing so

- if there is a registered business presence in India

The existing European LEI number is sufficient if there is no business presence in India. The RBI further specifies the requirements for companies present in India. it is necessary to apply for an LEI number in India and be included in the register:

- for legal entities that are borrowers with a credit volume of more than INR 50 million from banks

- if the company operates within over-the-counter (OTC) markets and conducts derivative transactions

- if a trade or issue takes place on the Indian stock exchange, irrespective of the instruments traded

- for large transactions with a volume of more than INR 500 million that are settled via NEFT (National Electronic Funds Transfer) or RTGS (Real-Time Gross Settlement) systems

The requirements also apply if the presence in India is merely a subsidiary and the parent company already has an LEI number issued in Europe.

Apply for an LEI number in India step-by-step

Apply for an LEI number in India is generally not complex, but companies should ensure an orderly process to avoid delays. Below, you will find a description of the individual steps and phases – as these build on each other, they should always be carried out in the respective order.

Step 1: Checking the necessity

If the requirements outlined above are met, which should be checked in advance, a local application for the Legal Entity Identifier must be made. Just like those issued in Europe, these are always alphanumeric identifiers with 20 digits or letters that enable a clear mutual assignment between the company and the Legal Entity Identifier.

Step 2: Selection of a local Indian LEI issuer

As in Europe, Legal Entity Identifiers in India are issued via so-called “Local Operating Units” (LOU for short). These are accredited and certified LEI issuers previously verified by the umbrella organization Global Legal Entity Identifier Foundation (GLEIF). A Legal Entity Identifier is only valid if accredited LOUs issue it. However, the LOU itself does not necessarily have to have its registered office in India: Internationally operating LOUs whose catchment area includes India would also be eligible.

Please note that there are no standardized guidelines regarding the fee structure or, for example, processing times. Consequently, it may be advisable for companies to check with the respective Indian and/or global issuers in advance. In particular, the expected processing time sometimes varies according to the LOU’s current workload, which makes it necessary to check on a daily basis at the time of application.

However, a long processing time is not normally expected: The LEI Register India, for example, often issues the number on the same working day or the next working day at the latest.

Step 3: Gather the necessary documents and information

Before you apply for an LEI number in India, ensure you have all necessary documents in digital format. These digital copies will be required for online upload to the respective Local Operating Unit (LOU). This documentation serves to verify your authorization to represent the company and confirm the company’s legal existence.

The documents required for this vary depending on the company’s legal form. In Germany, for example, you should have an official extract from the commercial register and Level 2 data ready if there is a corporate structure with parent companies. Partnerships must submit the partnership agreement and certificates such as GST or UDYAM, and the official PAN card may also be required – the same applies to a certificate of incorporation.

Regardless of the legal form, the documents must prove the company exists. The LEI.net/IN lists the following as examples of the required “Registration ID”: CIN, GSTIN, NGO ID or IEC.

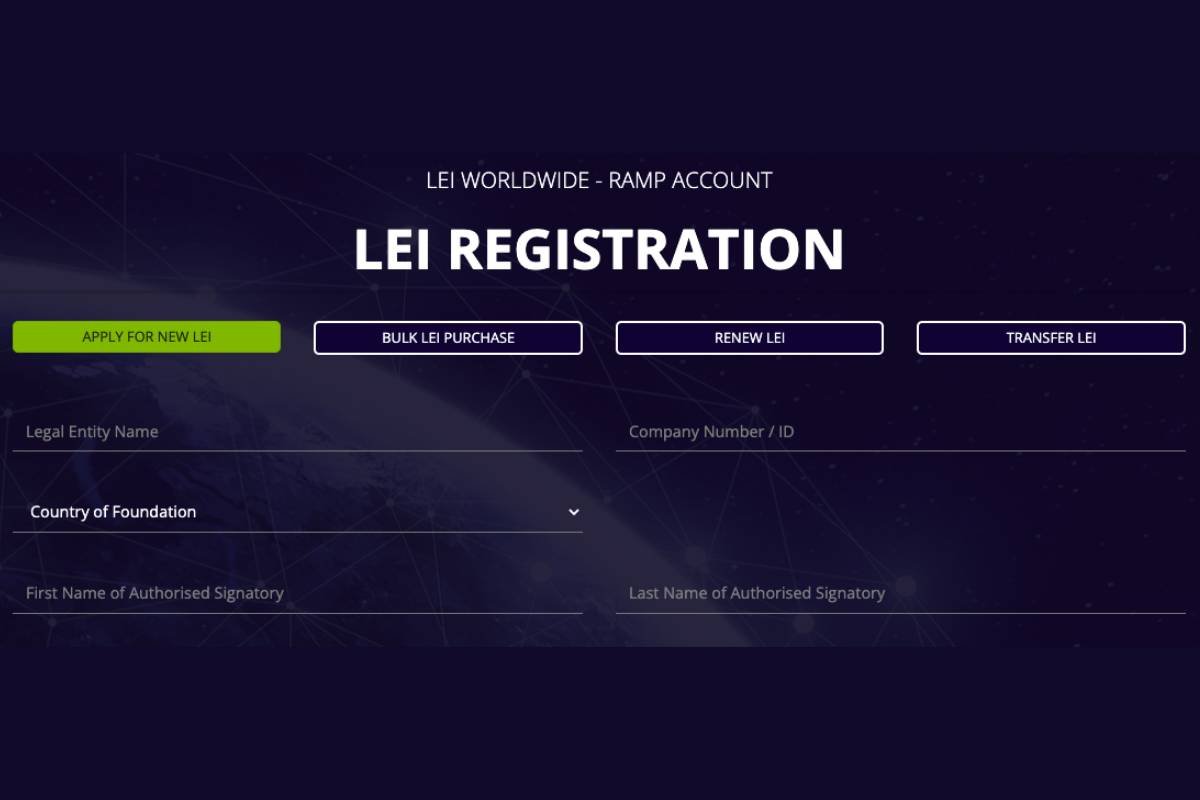

Step 4: Completing the necessary forms with the LOU

The application is made online: The relevant documents are now uploaded there to confirm the registration of the company or subsidiary. At the same time, you will have to provide some information about yourself and the respective company.

These are typically

- Your first and last name

- An e-mail address for contact purposes

- And a telephone number

- The official address of the branch in India, including the PIN code

- The name of the company

- The registration ID of the company

You must also complete an LOU questionnaire as part of the application process. For example, you will be asked whether the legally registered address of the company is identical to the head office or whether natural persons exclusively control the company. If not, further information on the corporate structure or parent company is required, including, for example, whether annualized financial reports are submitted consolidated or whether further levels exist within the corporate structure. The aforementioned Level 2 documents are also required if this is the case.

Step 5: Completion of the registration process

You can submit the application once you have entered all the details and supported them with the necessary uploaded documents. Payment of the LOU is now also required. The price structures vary in this respect, but you can generally expect to pay a minimum of 5000₹ and a maximum of 10000₹ per year. At the LEI.net/in, issuing a valid Indian LEI currently costs around 5900₹. Suppose you plan to participate in financial market transactions in India for several years. In that case, you can even book packages over several years, which will slightly reduce the effective annual costs – however, yearly renewal is still necessary.

After the LOU in India has viewed the information and documents, it will decide on the issue. The LEI Register India, for example, advertises processing times of less than three hours – provided all the necessary information and documents have been submitted immediately. At the annual renewal, which is required globally in every country, changes only need to be made if something has changed in the corporate structure or, for example, the Indian registered office of the entity during this time.

Further tips for apply for an LEI number in India without delay

The application should be made by someone who can speak English to at least a good level. You do not have to talk to an Indian, but the LOUs generally do not offer a German translation of the application. Instead, this is almost always done in English.

When entering the data, make sure that you do not make any mistakes or misspell any letters. Unsurprisingly, these will usually lead to a rejection, and the fees will not be reimbursed. Also, make sure that all information matches that on official documents and in the commercial register; otherwise, no LEI number will be issued.

Even though the processing times in India are usually very short, you should take care of the application promptly in case of any queries. Until the LEI number has been issued, you are not allowed to operate on the Indian financial markets and are not entitled to higher bank loans, for example. You should keep the LEI number issued later in a safe place, and you can also check the information stored for it at any time in the publicly accessible GLEIF register.

If you encounter specific hurdles when applying, Indian LOUs also offer personal customer service, which can usually be reached via live chat or telephone. Here, too, however, it is necessary that you or the responsible employee can communicate in English.

Conclusion: The LEI application in India is neither complex nor time-consuming

When you apply for an LEI number in India, you’ll find the process mirrors the standardized procedures in other countries where LEI numbers are required. The global standards established and monitored by institutions such as GLEIF are an excellent advantage for foreign companies. If you already have a European LEI number, you will notice during the application process that the entire procedure does not differ in this respect. In any case, it is essential that you compile the required company documents in digital form in advance and, at the same time, choose an issuing authority authorized by GLEIF.