In today’s evolving aviation landscape, the dynamics of aircraft leasing are changing rapidly. What was once a straightforward financial transaction has become a strategic endeavour that requires both technical insight and operational foresight. With fleets aging and sustainability goals reshaping the market, maintaining and optimising aircraft throughout their service lives has never been more critical.

These pressures have given rise to a total lifecycle asset management, one that integrates turnkey services such as engineering, maintenance, and data-driven oversight from acquisition to retirement. Looking looking beyond short-term gains allows lessors and operators to protect their assets’ values and improve long-term returns.

The sections that follow explore how this comprehensive strategy is redefining modern leasing practices.

The Shift Toward Lifecycle Thinking in Aircraft Leasing

The aviation industry is undergoing a strategic shift in how aircraft assets are managed. As sustainability goals tighten and reliability becomes non-negotiable, lessors and operators are reevaluating how leasing strategies affect long-term returns. Instead of focusing solely on short-term lease cycles, stakeholders are now evaluating how each decision, from acquisition to end-of-life, affects the aircraft’s overall performance and financial trajectory.

This shift has elevated total lifecycle asset management from a back-office function to a central strategic priority. It encourages a more deliberate alignment between technical planning and commercial objectives, ensuring that maintenance schedules, modification strategies, and remarketing efforts are coordinated to support both operational readiness and revenue potential.

Treating lifecycle oversight as a framework for value creation rather than a cost to be minimised lets leasing stakeholders gain the flexibility they need to respond not only to market shifts and regulatory changes but also to evolving fleet needs. This mindset is key to making smarter, data-informed decisions that protect asset integrity and enhance long-term leasing outcomes across diverse operating environments.

Integrating MRO and Technical Expertise to Preserve Asset Value

The single greatest threat to an aircraft’s value is unchecked degradation. For lessors, the residual value, the asset’s worth at the end of the lease term, is paramount to long-term profitability. This makes the integration of maintenance, repair, and overhaul (MRO) services a core component of any sound lifecycle strategy.

Technical oversight, including airframe, component, and engine services, is more than a routine cost. It is an investment in asset integrity. High-quality MRO ensures regulatory compliance and operational performance for the current lessee, while safeguarding the aircraft’s physical condition and documentation. When remarketed or transitioned, a well-managed technical history reduces downtime and costly adjustments, helping preserve or even enhance residual value.

Lifecycle asset management also relies on specialised expertise in inspection protocols and documentation review. These practices guarantee that aircraft remain desirable in competitive leasing environments. By minimising transition risk and maximising readiness, technical precision enables stakeholders to secure stronger lease terms and achieve more consistent financial outcomes.

Reconfiguration and Conversion as Tools for Asset Flexibility

Market demand in aviation rarely stays still. Passenger routes expand, cargo volumes surge, and economic shifts can alter fleet priorities with little warning. To stay ahead, lessors and operators need the ability to reposition assets without replacing them. Reconfiguration and conversion services make this possible, enabling a single aircraft to shift roles, from short-haul passenger service to dedicated cargo operations, through targeted design and engineering modifications.

These adaptations do more than alter physical layout; they extend the economic life of high-value assets. Cabin reconfiguration updates interiors to meet evolving passenger expectations, while passenger-to-freighter conversions unlock new revenue opportunities in the air-cargo sector. Each modification requires precise technical planning and compliance oversight, which are both central to lifecycle asset management.

Anticipating shifts in utilisation and embedding flexibility into asset strategy strengthen portfolio resilience and protect long-term returns. In a dynamic market, adaptability is just as vital as reliability in shaping aircraft leasing success.

Data-Driven Asset Management and Risk Mitigation

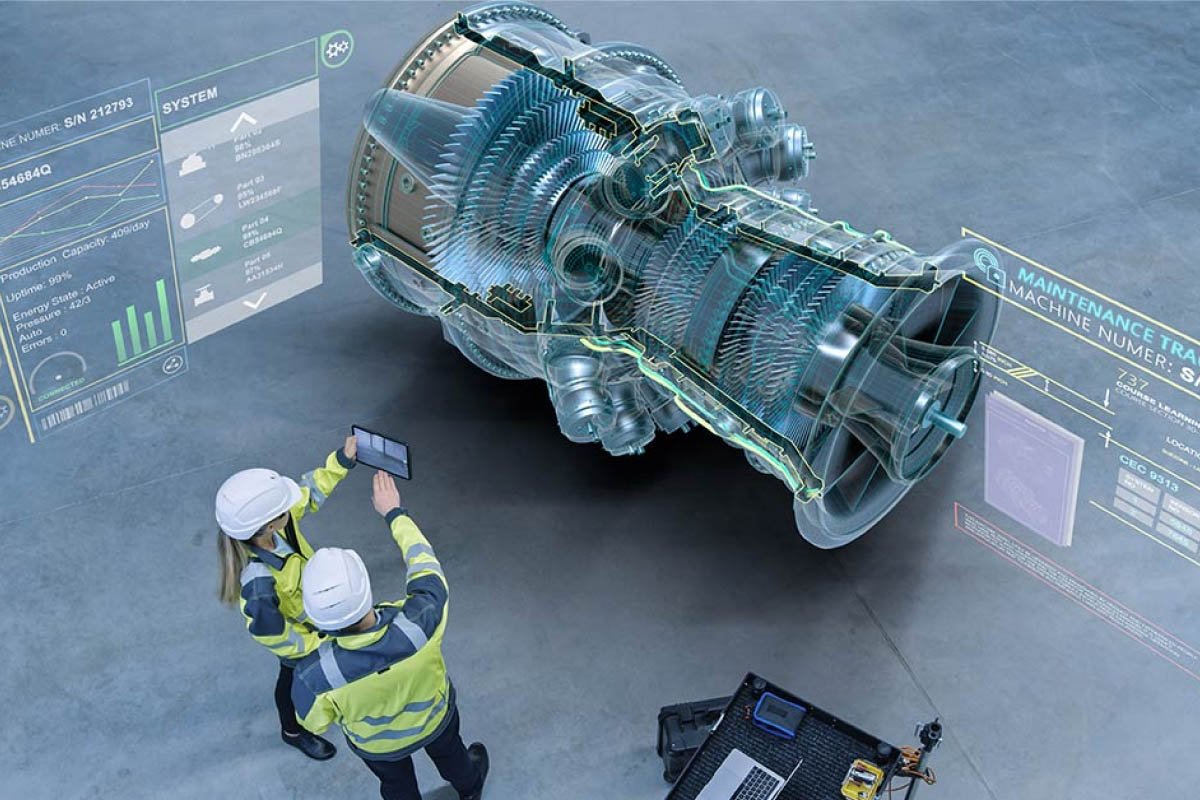

Information has become one of aviation’s most valuable resources. Through digital monitoring, predictive maintenance, and data analytics, lessors and operators gain real-time visibility into aircraft performance across their service lives. This insight transforms decision-making by covering everything from determining optimal maintenance intervals to predicting component wear, allowing for timely interventions that prevent costly surprises.

Data integration also strengthens risk mitigation throughout the lease cycle. Accurate records validate an aircraft’s technical condition, improve transparency between stakeholders, and build trust during transitions or remarketing. For portfolio managers, long-term analytics reveal performance trends that guide investment and retirement strategies.

When lifecycle asset management is driven by reliable data, outcomes become more predictable and sustainable. The ability to connect technical, operational, and financial information ultimately transforms asset oversight into a strategic advantage, one that supports stronger returns and greater resilience in modern aircraft leasing.

Collaborative Ecosystems That Align Lessors and Operators

Strong partnerships underpin every successful leasing strategy. Aircraft often change hands multiple times and may operate under different carriers or jurisdictions throughout their lifespan, which makes close cooperation between lessors and maintenance partners essential. Effective lifecycle management, in turn, depends on transparency and coordination that keep assets productive, compliant, and ready for transition.

When stakeholders align their objectives, they create a continuous exchange of operational and technical insight to the benefit of all parties. Maintenance planning becomes more efficient, transitions are smoother, and unexpected costs are easier to avoid. Collaboration also fosters accountability, as each participant understands how technical decisions influence financial results. Over time, this interconnected approach replaces transactional relationships with long-term partnerships focused on asset health and performance.

In an industry where timing and precision are critical, shared responsibility ensures that lifecycle strategies deliver not only operational stability but also enduring value across the aircraft’s service life.

Better Asset Lifecycle Stewardship Means Better Aircraft Leasing Outcomes

Total lifecycle asset management has redefined aircraft leasing, transforming it from a transactional exchange into a long-term strategic partnership. By integrating specialized technical services and leveraging predictive data, lessors and operators safeguard asset value against market volatility and degradation. For industry stakeholders, the lesson is clear: sustained profitability demands moving beyond simple ownership to embracing proactive, end-to-end asset stewardship.