Every investor, no matter how distant, is concerned about the possibility of a massive Stock Market Crash. That has occurred previously. That may happen again. Years of hard-earned savings and retirement money might be wiped away in hours if this happens.

Thankfully, you can protect the majority of your assets from a market catastrophe or even a worldwide economic crisis. A good defensive plan includes preparation and diversity. They can work together to help you withstand a financial storm.

Here are 5 Tips to Protect Yourself from a Stock Market Crash;

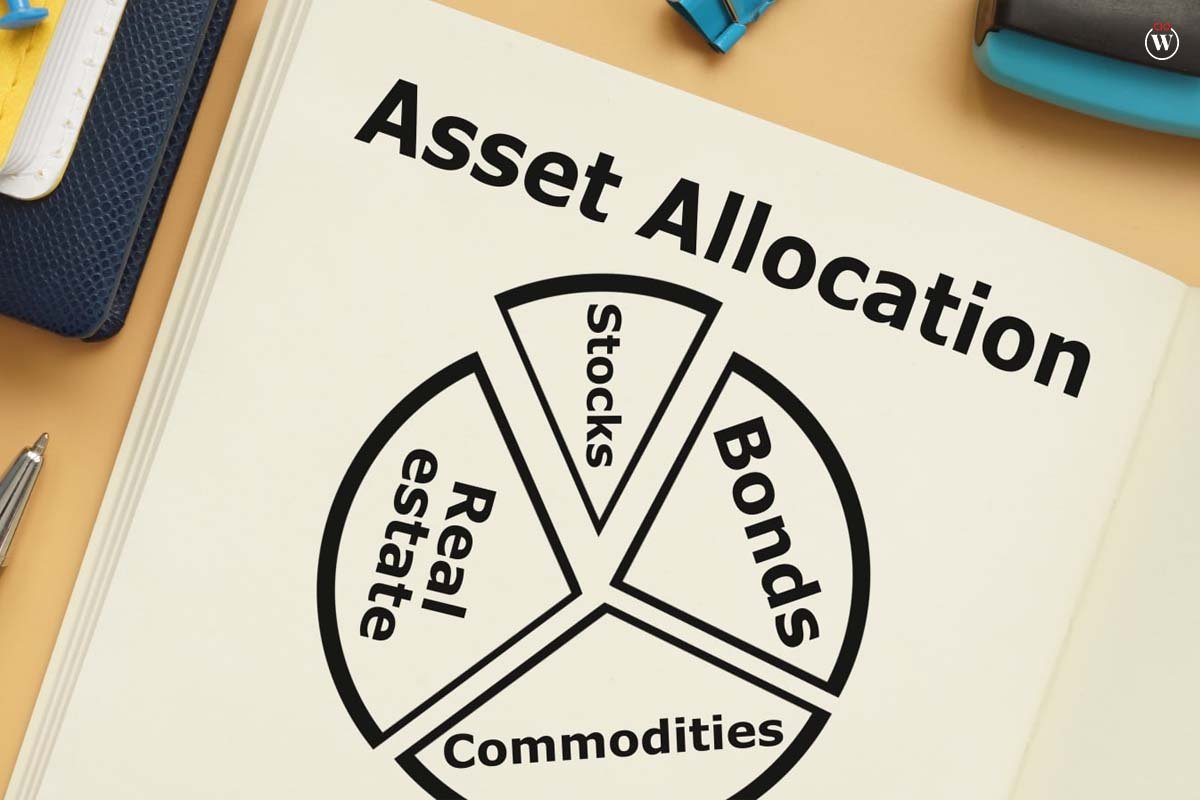

1. Diversify

Diversifying your portfolio is most likely the single most essential thing you can do to protect your money from a severe bear market.

Depending on your age and risk tolerance, you may be able to invest the majority of your retirement assets in individual stocks, stock mutual funds, or exchange-traded funds (ETFs).

Yet, if a crisis appears, you must be prepared to relocate at least a part of that money into something safer.

People may now invest their money in a variety of products, each with its own degree of risk: stocks, bonds, cash, real estate, derivatives, cash value life insurance, annuities, and precious metals, to name a few. You may also experiment with different assets, such as a minor stake in a producing oil and gas production.

Distributing your money over many of these categories is the greatest approach to guarantee that you have something to fall back on if the bottom falls out.

2. Take a flight to safety

When there is significant market volatility, most professional traders go to cash or cash equivalents. You may wish to do the same if you have time before the Stock Market Crash.

If you leave fast, you may return at a considerably lesser price. When the trend inevitably reverses, you may benefit even more from the increase.

3. Get a Guarantee

You most likely do not want to put all of your cash into guaranteed investments. They just do not pay off enough. Therefore, it is prudent to preserve at least a modest percentage in something that will not collapse with the Stock Market Crash.

Bank CDs and Treasury securities are solid investments for the near term.

If you want to invest for a longer length of time, fixed or indexed annuities, or even indexed universal life insurance policies, may outperform Treasury bonds. Corporate bonds and even preferred stocks of blue-chip corporations may give competitive income with little to no risk.

4. Protect Your Investments

If you detect a severe Stock Market Crash coming, don’t be afraid to position yourself to benefit straight from it. There are numerous approaches you may take, and the ideal one for you will be determined by your risk tolerance and time horizon.

If you possess shares of a stock that you believe will decline, you might sell it short and then buy it back when the chart patterns indicate that it is likely near the bottom.

This is simpler to do if you already possess the stock you want to short. If the Stock Market Crash against you, you may simply deliver your shares to the broker and pay the price difference in cash.

Another option is to purchase put options on any equities you own that have options or on one or more financial indexes. If the price of the underlying securities or benchmark falls, the value of these derivatives will skyrocket.

5. Pay off your debts

If you have significant obligations, you may be better off selling part or all of your assets and paying off your debts if you sense terrible weather in the markets. This is particularly prudent if you have a significant amount of high-interest debt, such as credit card balances or other consumer loans. At the very least, you’ll have a pretty solid balance sheet while the bear market rages.

Paying off your property, or at least a significant portion of your mortgage may also be a smart option. It is never a bad idea to reduce your monthly responsibilities.

6. Look for the Tax Silver Lining

If you are unable to directly protect your assets against a Stock Market Crash, there are still alternatives to mitigate your losses.

One possibility for losses experienced in taxable accounts is tax-loss harvesting. Just sell all of your lost holdings and then repurchase them at least 31 days later. (It implies selling before the end of the current tax year to realize the loss before Jan. 1, and then purchasing the stocks again, if you so desire, in 31 days or later.). The IRS would consider repurchasing the equities prior to this period to be a “wash sale,” and the opportunity to claim the loss would be denied.)

Then you may deduct all of your losses from any profits you made in those accounts. You may carry over any excess losses to the next year and deduct up to $3,000 in losses from your regular income each year.