Biden Weighs National Security Risks in Nippon Deal

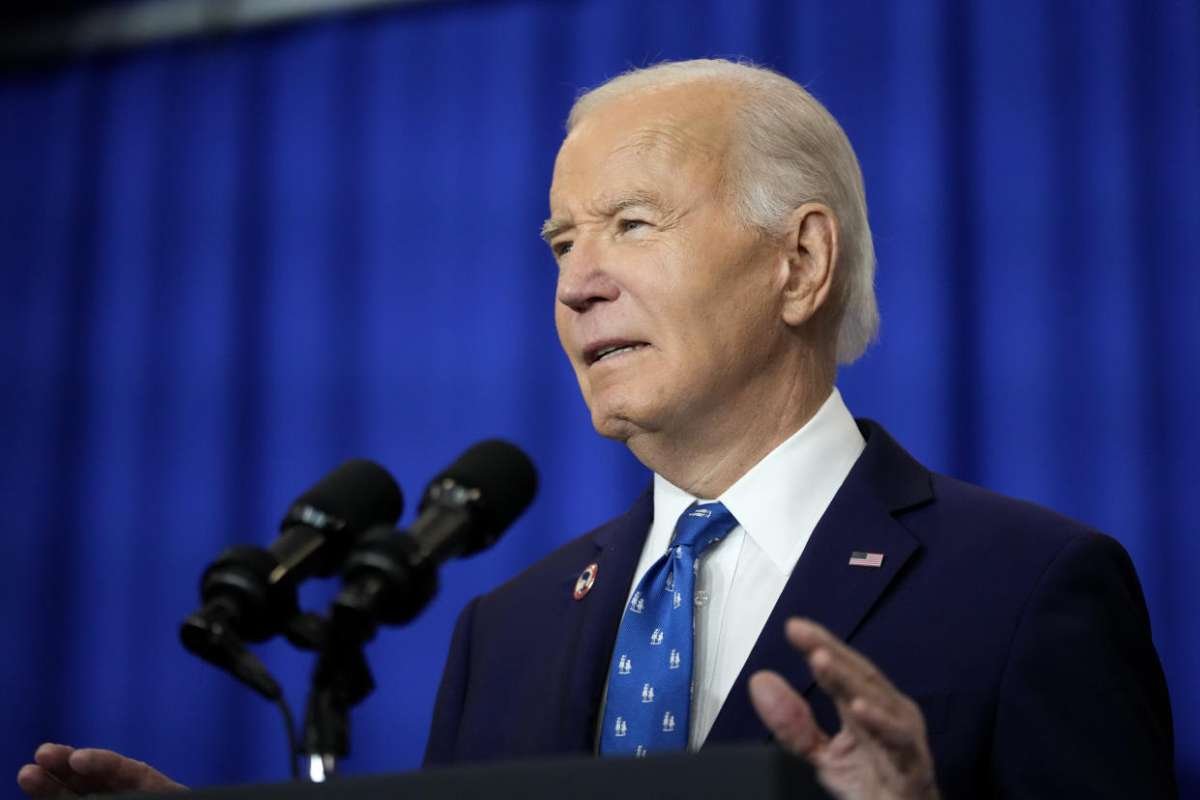

President Joe Biden now holds the final say in the controversial acquisition of US Steel and Nippon, following a deadlock among top government officials on the Committee for Foreign Investment in the United States (CFIUS). Sources close to the matter revealed that the committee, composed of high-level officials from various government agencies, could not reach a consensus on whether the sale poses a national security threat. This impasse puts Biden in a position to either approve or block the deal, with many expecting the president to halt the transaction to safeguard American steel jobs.

The months-long review has attracted significant political attention, with public opposition from Biden, Vice President Kamala Harris, and even President-elect Donald Trump raising concerns about the integrity of the process. Despite the stalemate, US Steel and Nippon maintain that the deal presents no security risks. Nippon has offered substantial commitments, including a $2.7 billion investment in unionized mills in Pennsylvania and Indiana. Yet, the political climate, driven by the desire to preserve domestic manufacturing, continues to overshadow the economic benefits touted by both companies.

Economic and Political Implications of the Deal

Nippon Steel’s bid for US Steel, valued at nearly double the price of an earlier hostile offer by Cleveland Cliffs, has sparked intense debate over its economic and national impact. Proponents of the deal argue that it offers a lifeline to US Steel, which has struggled to compete with cheaper foreign steel imports, predominantly from China. The company has warned that without the acquisition, it might have to shutter mills employing unionized workers. Nippon’s proposed multibillion-dollar investment is seen as a critical step toward revitalizing US Steel’s aging infrastructure and securing its future.

However, critics, including prominent politicians, view the transaction as a threat to American industry. The merger has become a bipartisan flashpoint, with lawmakers on both sides vowing to protect domestic manufacturing. Adding to the complexity, the US Department of Justice is conducting an antitrust review, further delaying the deal’s resolution. The competing narratives have made the acquisition contentious, placing Biden at the center of a high-stakes decision.

Future of the Deal Hangs in Balance

While Biden’s decision is imminent, it remains uncertain whether he will block the deal outright or push for a compromise that satisfies stakeholders, including the United Steelworkers union. Even if a negotiated solution emerges, the incoming administration under President-elect Trump has signaled strong opposition. Trump’s recent social media statements emphasized his intent to block the deal through tariffs and tax incentives to bolster American steel manufacturing.

As US Steel and Nippon’s deal faces uncertainty, US Steel’s stock dipped 3% in after-hours trading, causing ripples across the industry. For now, the fate of one of America’s oldest steelmakers rests with Biden, whose decision will not only shape the future of US Steel and Nippon but also set a precedent for how the nation balances economic interests with national security and political considerations.