Financial inclusion has become more imperative today than ever, particularly in Africa, where it can drive economic growth and prosperity. As Sabine Mensah (Deputy CEO at AfricaNenda), a champion for digital payments and financial inclusion, states: “Payment systems that are inclusive guarantee fair access to financial services for marginalized groups. They provide affordable, easily accessible, and safe transactions via a number of channels.”

These inclusive payment systems, as Mensah describes, promote economic inclusion by placing a high value on accessibility and variety of services. Their operations are supported by regulatory frameworks that encourage social development and financial empowerment. By providing people with access to financial services such as savings, loans, and insurance, communities can invest in education, start and grow businesses, and protect themselves against financial hardships.

This boosts the local economy and promotes social stability by reducing poverty and inequalities. Ensuring that these financial tools, delivered through inclusive payment systems, are accessible to all, including the most marginalized and remote populations, is crucial for fostering sustainable development and creating a more equitable society.

Preaching and promoting financial inclusivity with her leadership and financial expertise, Sabine is a well-rounded leader who prioritizes integrity, empowerment, and collaboration to support a thriving team. A transformational leader championing innovation, and inclusivity, her leadership in digital financial services significantly contributes to the fortification of financial inclusion across Africa.

Onwards to a Career in Finance

From a very young age, Sabine was certain she wanted to pursue a career in finance. Initially, she aspired to enter the banking sector, motivated by the belief that facilitating access to finance could significantly impact people’s futures. This conviction stemmed from her childhood experiences in Burkina Faso, her home country. Sabine’s perspective was shaped during her school years when she noticed that her best friend in middle school could not continue her education due to financial constraints. In contrast, she had the opportunity to follow her educational path.

This early realization underscored the importance of finance in enhancing various aspects of life, be it education, health, or basic sustenance. Thus, she was determined to work in the finance sector, specifically banking, believing it was the key to enabling greater opportunities for others. After completing her studies, Sabine returned to Burkina Faso and started working at a commercial bank. During this period, she recognized that one could facilitate access to finance without necessarily being part of a banking institution. This insight led her to explore the realms of financial inclusion, digital payments, and remittances, marking the beginning of her journey in these fields.

Illustrious Professional Journey

In 1997, Sabine began her career at Ecobank in Burkina Faso as a financial analyst, where her responsibilities primarily involved facilitating financing for small and medium-sized enterprises (SMEs). Sabine’s prior experience, while highlighting the importance of strong analytical skills, also instilled in her a desire for a work environment that valued objective decision-making. This led her to seek a new opportunity, a perfect match being presented by SNC Finance, one of the first remittance agents for Western Union in West Africa.

Sabine then moved from Burkina Faso to Côte d’Ivoire to join a new venture working as a Western Union agent. Her insights on the potential impact of non-bank financial services in Africa, especially for money transfers, made a lasting impression. Sabine’s remarkable computer skills and English proficiency, a major advantage in the French-speaking environment, led to a pivotal career move with SNC Finance. Her overlooked talent for using English-language manuals quickly proved its value, making her a key contributor and eventually the primary contact for global remittance partner Western Union.

Following her success at SNC Finance in Côte d’Ivoire, she was given the opportunity to return to Burkina Faso to expand SNC Finance footprint as a director of administration and finance at SNC Burkina. Her knowledge and application of the operational manuals positioned her as a key player in deploying Western Union’s services in Burkina Faso.

Sabine’s career trajectory continued upwards, which led to a job offer from the Western Union’s corporate headquarters in New York, US, in 1999 as an international business development specialist. This role expanded her focus to cover the African diaspora in the US and Canada; and later to a broader international remittance scope, which eventually led to her promotion as the regional director for remittances with Western Union Canada.

Sabine’s accomplishments fuelled her desire for further professional growth, leading her to pursue new opportunities. In 2013, Sabine relocated to Kenya. Her decision was driven by a desire to contribute to Africa’s financial inclusion journey and leverage the burgeoning mobile money sector, inspired by projects like the integration of Western Union directpay to M-Pesa wallets in Kenya. Her work in consulting for the mobile money industry in Africa, and later with the United Nations Capital Development Fund (UNCDF) inclusive digital economy team, further solidified her belief in the power of non-traditional banking to achieve financial inclusion outcome for the most vulnerable and excluded populations in Africa.

Seeking new opportunities, Sabine made the decision to depart UNCDF and joined AfricaNenda in July 2021. Here, she continues her work on financial inclusion and inclusive instant payment systems, embodying her enduring commitment to leveraging finance for empowerment and economic development.

Financial Inclusion at the Heart

African countries have a strong demand for instant payment systems. The demand for preliminary project assistance and enhanced institutional capacity across Africa is critical to overcoming barriers hindering the development and expansion of inclusive instant payment systems in Africa Investing in pre-project support, technical assistance, knowledge sharing and building stronger internal capacity will contribute to accelerate the growth and inclusivity of these much-needed systems.

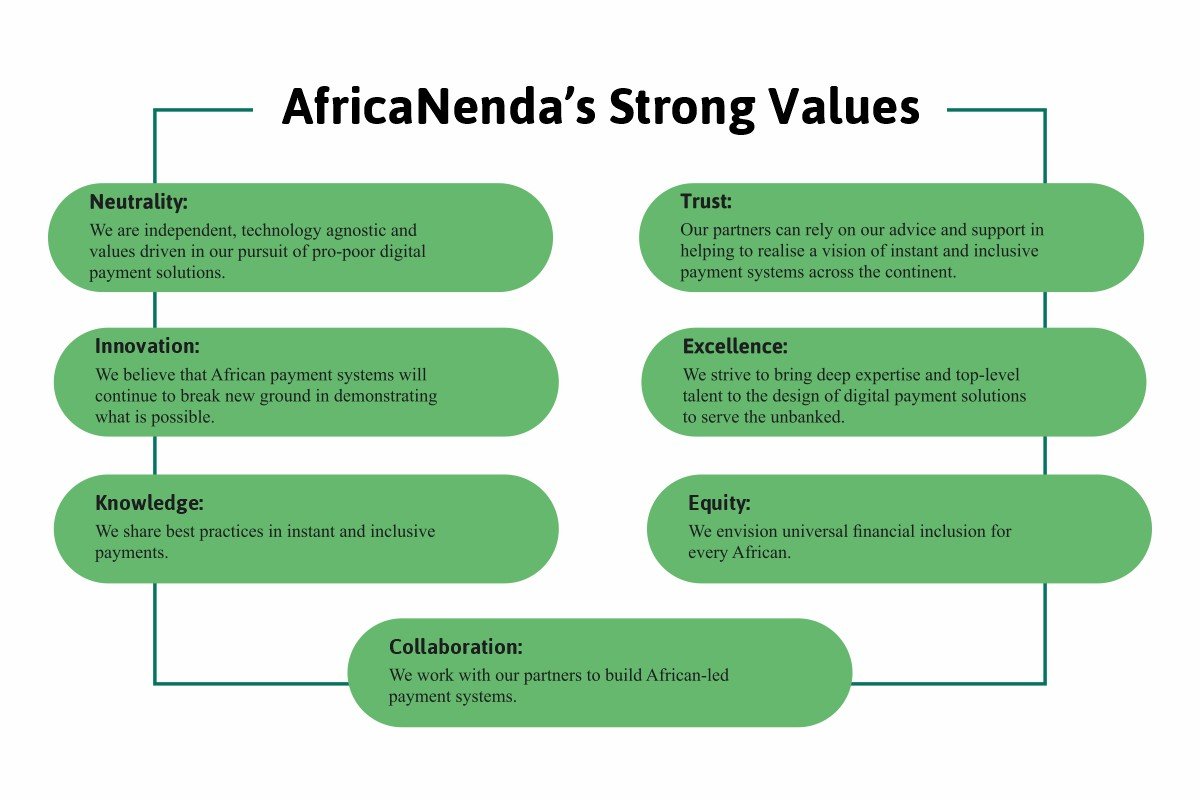

An African-driven, self-sufficient entity, AfricaNenda was established to accelerate the development of inclusive instant payment systems that will extend benefits to all Africans, particularly those currently excluded from the formal financial ecosystem. The team comprises seasoned professionals in digital payments alongside visionary leaders endowed with profound regional insights. The organization aims to offer guidance and technical assistance to African institutions and governmental bodies, fostering a collective effort towards advancing financial inclusion and economic empowerment across the continent.

AfricaNenda Array of Services

AfricaNenda provides pre-project planning assistance to broaden the pipeline of viable projects focused on inclusive instant payment systems.

- Readiness assessment

Working with project owners to determine the economic feasibility of a potential deployment of inclusive instant payment systems and identify areas that need support.

- Project definition and vision

Equipping payment system project owners to define project objectives and design principles, as well as identify, convene, and align key payments stakeholders.

- Inclusive instant payment system design and structuring

Supporting project owners in developing work plans and budgets, and in identifying partners to provide project facilitation, and technical assistance and implementation.

In addition to the above, AfricaNenda also works to enhance the capacity of African institutions, payment experts, and other key stakeholders.

Inclusive Growth Strategies

- Institutional Capacity Building

Helping to build capacity in the market by providing seconded technical experts and ad hoc technical assistance to support pan-African institutions in scaling digital payments initiatives.

- Knowledge Transfer and Sharing

Convening stakeholders across the African payments ecosystem to share experiences and best practices and to accelerate the agenda for universal financial access across the continent.

- Inclusive Instant Payment Systems Tools

Building actionable and evidence-based tools, playbooks, and training on instant and inclusive payment systems to reduce project initiation and design costs and complexity.

- Digital Payments Training

Supporting the training of the next generation of African payments talent in partnership with top professional development institutions.

On Leadership, Entrepreneurship, and Aspirations

Leveraging her strong leadership experience in digital payments and mobile money across the multilateral and private sectors, Sabine spearheads the AfricaNenda team as one of the deputy CEOs. She oversees the policy, advocacy and capacity-building through strategic partnerships, convenings and thought leadership to strengthen the digital payment ecosystem across Africa.

In the tapestry of Sabine’s career, a pattern of leadership and integrity emerges, woven from her experiences across continents and sectors. Her journey, marked by dedication and a relentless pursuit of fairness, offers a blueprint for aspiring leaders. “Leadership”— Sabine often reflects, “is not just about directing; it’s about embodying the principles you wish to see in your team.”

From her early days in Burkina Faso to her pivotal roles on the international stage, Sabine has consistently championed the philosophy of “walking the talk.” She believes that the essence of leadership lies in being a living example of the values and behaviours one expects from others. “The most effective way to motivate your team,” she says, “is to be the shining beacon of the behaviour you advocate for.

It’s about painting a compelling vision that people are not just willing but eager to contribute to, driven by belief in the vision and their leader’s integrity.” Throughout her career, Sabine has encountered moments where the actions of managers did not align with their words, a discrepancy that she found deeply demotivating. Drawing from these experiences, she solemnly pledged herself and her future teams to lead authentically and ensure her actions and words were in harmony. “When leaders walk the talk,” she asserts, “they build an environment where trust flourishes and innovation thrives.”

Another cornerstone of Sabine’s leadership philosophy is recognizing effort and achievement. “Recognizing performance and the behaviours you want to encourage within your organization is crucial,” she notes. “It can be as simple as immediate feedback or as public as a commendation in a forum. Recognition has always been a powerful motivator for me, driving me to pursue excellence in everything I do.

” Sabine also emphasizes the importance of truly knowing and understanding one’s colleagues and advocates for creating a space where team members feel valued and understood and where their strengths can be leveraged to the fullest. Sabine’s story is a testament to the impact of leading by example, recognizing the achievements of others, and fostering an environment of mutual respect and trust. “At the end of the day,” she concludes,

“leadership is about lifting others to achieve their full potential. It’s a journey of constant learning, listening, and growing together.”