Retail and Industrial Growth Offer Encouraging Start to the Year

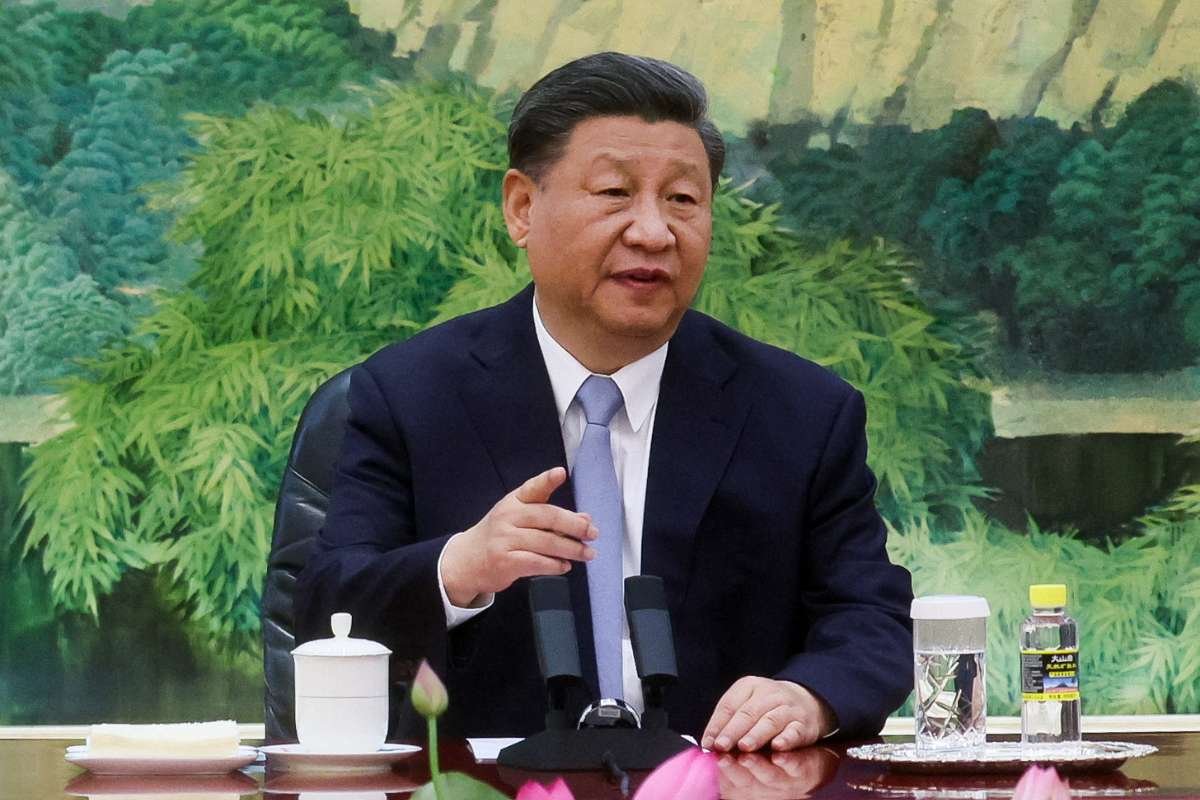

China’s economy showed signs of a modest recovery in the first two months of the year, as retail sales and industrial output exceeded expectations, according to data released by the National Bureau of Statistics (NBS) on Monday. Retail sales grew by 4.0% year-on-year in the January-February period, up from December’s 3.7% growth, aligning with market forecasts. Meanwhile, industrial production rose by 5.9%, surpassing analysts’ projections of 5.3% but slowing from December’s 6.2% increase. Notably, the equipment-making and high-tech manufacturing sectors expanded by 10.6% and 9.1%, respectively, highlighting the resilience of these industries.

Fixed asset investment also saw a notable rise, climbing 4.1% year-to-date, exceeding the estimated 3.6% growth and improving from last year’s 3.2% increase. The NBS credited this economic upturn to the effects of various stimulus measures implemented by Beijing. However, officials also acknowledged the presence of external uncertainties, weak domestic demand, and operational difficulties faced by enterprises.

Policy Measures and Economic Challenges Persist

The release of this data follows Beijing’s renewed commitment to stimulating domestic consumption. A notice issued on Sunday emphasized efforts to stabilize the stock market, implement childcare subsidies, and enhance the tourism sector. While lacking detailed execution plans, the policy direction reflects China’s recognition of deep-rooted economic challenges, including slowing income growth and a fragile social safety net. Lynn Song, Chief China Economist at ING, noted that the government’s stance indicates a willingness to transition towards a consumption-driven economy.

China’s economy is facing persistent challenges, as evidenced by rising urban unemployment. Despite these efforts, China’s urban unemployment rate rose to 5.4% in February, marking its highest level in two years. Additionally, the real estate sector continued to struggle, with new home prices declining by 4.8% in February compared to a 5.0% drop in January. Investment in real estate development contracted by 9.8% in the first two months of the year, though it showed a slight improvement from the 10.6% decline recorded in December. Analysts suggest that policymakers’ credit support for property developers is beginning to yield results, but sustained recovery remains uncertain.

Also read: China’s Factory Activity Reaches Three-Month High Amid Economic Uncertainty

Growth Target Faces Mounting Pressure

Chinese leadership has set an ambitious economic growth target of around 5% for the year, a goal that experts believe will be difficult to achieve amid rising trade tensions with the U.S. and ongoing deflationary concerns. Fu Lingui, spokesperson for the NBS, acknowledged the challenge, stating that reaching this target “will not be easy.”

Exports, which accounted for nearly a quarter of China’s GDP last year, experienced a significant slowdown in early 2024, while imports declined due to weak domestic demand. Consumer price inflation dipped below zero in February for the first time in over a year, prompting Beijing to revise its annual inflation target to around 2%, the lowest in more than two decades.

As part of its fiscal stimulus strategy, China announced an additional 300 billion yuan ($41.5 billion) in ultra-long special treasury bonds to support consumer subsidies. However, experts caution that while the policy direction is promising, its success will depend on local implementation and adequate resource allocation. Alfredo Montufar-Helu, head of the China Center at The Conference Board, emphasized that the impact of these measures on China’s economy remains uncertain, stating that effectiveness hinges on execution at the regional level.

With a complex economic landscape ahead, China’s ability to sustain its recovery will depend on its policy execution, external market conditions, and consumer confidence.