Women have come to transform the finance industry by offering unique insight and innovating it in new ways. They challenge the status quo in key decision-making, enriching diversity and outcomes of finances. The leadership role of women has been best exemplified through women-owned Banks in the US, such as the First Women’s Bank in Chicago. Such institutions have laid down a pathway for financial inclusion by empowering women entrepreneurs and fighting for gender equality in business. This is evident by their success and implies that women’s financial support is essential to facilitate a more inclusive, resilient, and growth-friendly financial system and economic growth. It promotes a sustainable future if more women are involved in finance.

Why Women-Owned Banks in the US Matter

The financial sector had predominantly masculine management at its helm, but banks founded and led by women have redefined this scenario. A women-owned bank centers the closing the gap regarding financing for women. To bring equity, they promote financial education while proposing suitable customized banking and financing products to such populations in neglected local economies. Second, women-owned banks in the US promote diversity not only at the top level but also in the services offered. While assisting a female entrepreneur get funding, or guiding a family in creating a generational wealth, the presence of these banks is the pillar of women’s economic empowerment.

1. Agility Bank: Banking for the Modern Woman

Agility Bank, which is located in Houston, Texas, stands out as one of the best women-owned banks in the US founded by Lauren Sparks. A bank tailored for small businesses and entrepreneurial women, Agility Bank serves as a Minority Depository Institution. Their objective is evident: empower women and minorities through accessible financial solutions. Agility Bank utilizes technology to provide easy access to banking services while emphasizing personal relationships. Its hybrid model, which combines traditional banking with digital innovation, serves the needs of modern-day female entrepreneurs. Agility Bank has, therefore, emerged as a leader in promoting inclusive economic growth.

2. BancCentral National Association: A Legacy of Leadership

BancCentral National Association, based in Alva, Oklahoma, is another noteworthy women-owned bank in the US owned by the Myers family. With a history dating back to 1913, it is now led by women dedicated to preserving the bank’s rich heritage while driving innovation. Female leadership in BancCentral Bank, emphasizes community banking, which offers solutions that respond to the needs of local businesses and families. This service and innovation commitment underscores the critical role women play in shaping the financial industry’s future.

3. Beacon Business Bank: Lighting the Way

Beacon Business Bank, based in California, is a great example of how women-owned banks in the US can light up the way for businesses and individuals to succeed. The bank specializes in business banking services, helping small to mid-sized businesses thrive in a competitive market.

Beacon Business Bank’s leadership is committed to financial literacy and empowering women’s entrepreneurship. They have customized loan products and cash management with a focus on the diverse needs of their customers. Their community development approach reflects their belief in stimulating economic growth through collaboration.

4. Commercial National Bank of Texarkana: A Community Staple

Commercial National Bank of Texarkana is one of the women-owned banks in the US with a strong focus on community service. Situated on the Texas-Arkansas border, this institution has long been a cornerstone of its region, offering robust banking services while fostering local economic development.

Committed to relationship banking, the bank ensures its customers receive the personal attention they deserve. From loan provisions to small businesses and guiding customers throughout homeownership, the Commercial National Bank of Texarkana is actively engaged in lifting the community.

5. First National Bank Alaska: Pioneering in the Last Frontier

First National Bank Alaska is one of the well-known women-owned banks operating in one of the nation’s most unique financial landscapes. The bank headquartered in Anchorage, Alaska, offers financial products to a diverse populace located both in remote areas and vibrant cities.

This bank is recognized for its culture of innovation and accessibility. The females in leadership make this institution push the bank into further initiatives that incorporate underserved communities into banking and services. First National Bank Alaska embodies the transformation of women-owned banks to thrive in difficult market conditions with a customer-centric approach.

The Broader Impact of Women-Owned Banks

The influence that women-owned banks in the US hold extends beyond their clients. These banks are advocates for gender equity in financial services and promote the same throughout the industry. Through unique leadership, these banks disprove conventional norms since diverse leadership is not only possible but also considerably advantageous.

Moreover, these institutions play a vital role in promoting financial inclusion. They usually target unbanked markets, for example, rural areas or ethnic minorities, to ensure that nobody is left behind. The impact of women-owned banks has rippling effects that benefit society at large.

Challenges and Opportunities

Although women-owned banks continue to grow, US-based institutions still have great challenges in their quest to increase market share. The challenges include competition from giant financial institutions as well as relatively low public awareness. However, growth opportunities abound in areas like technology enhancement, partnerships, and business-specific marketing.

Another area is financial literacy. Educating customers about the benefits of women-owned banks and the services they provide can attract a wider audience and instill confidence in their mission.

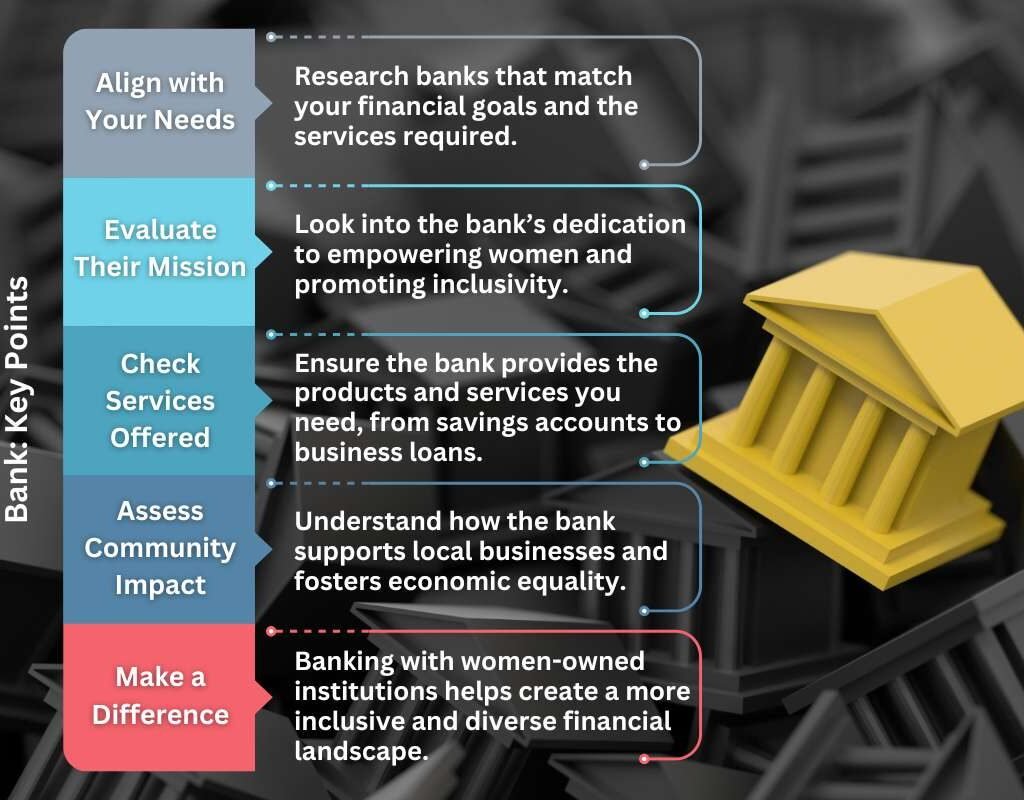

Choosing a Women-Owned Bank: Key Points

- Align with Your Needs: Research banks that match your financial goals and the services required.

- Evaluate Their Mission: Look into the bank’s dedication to empowering women and promoting inclusivity.

- Check Services Offered: Ensure the bank provides the products and services you need, from savings accounts to business loans.

- Assess Community Impact: Understand how the bank supports local businesses and fosters economic equality.

- Make a Difference: Banking with women-owned institutions helps create a more inclusive and diverse financial landscape.

Final Thoughts

Women-owned banks in the US are transforming financial institutions, promoting diversity, empowering entrepreneurs, and ensuring economic inclusion. Institutions such as Agility Bank, BancCentral National Association, Beacon Business Bank, Commercial National Bank of Texarkana, and First National Bank Alaska embody the transformative potential of women-led leadership in finance. The banks, which are increasing in size and innovativeness day by day, open roads for a more equitable future. Supporting women-owned banks is not just about financial decision-making; it’s supporting inclusivity, innovation, and empowerment in the financial world.