More people are interested in renewable energy, leading homeowners and businesses to look at solar energy as a good choice. With energy costs going up and more awareness of environmental impacts, solar energy is a sustainable and cost-effective solution. One of the biggest reasons to switch to solar energy is the solar energy tax credits available. This guide will help you understand how to save the most money with these tax credits, giving you the information you need to make the most of these financial benefits.

Understanding Solar Energy Tax Credits

Solar energy tax credits are government incentives designed to encourage the adoption of solar power systems. These credits reduce the amount of tax you owe, making the installation of solar panels more affordable. The federal government, along with various state and local governments, offers these incentives to promote clean energy and reduce reliance on fossil fuels.

Federal Solar Investment Tax Credit (ITC)

The most well-known solar energy tax credit is the Federal Solar Investment Tax Credit (ITC). Established in 2006, the ITC allows homeowners and businesses to deduct a percentage of the cost of installing a solar energy system from their federal taxes. As of 2024, the ITC provides a 26% tax credit for systems installed through the end of the year. This percentage is scheduled to decrease in the coming years, so it’s crucial to take advantage of this incentive as soon as possible.

State and Local Incentives

In addition to the federal ITC, many states and local governments offer their own solar energy tax credits and rebates. These incentives can vary widely depending on your location. Some states provide substantial credits that can significantly reduce the overall cost of your solar installation. It’s essential to research and understand the specific incentives available in your area to maximize your savings.

Eligibility Requirements for Solar Energy Tax Credits

To benefit from solar energy tax credits, certain eligibility requirements must be met. Understanding these requirements ensures that you can take full advantage of the available incentives.

Qualifying Properties

Solar energy tax credits are available for both residential and commercial properties. For residential properties, the solar panels must be installed on a primary or secondary home that you own. Rental properties do not qualify for the residential ITC but may be eligible for commercial tax credits.

Qualifying Solar Systems

Not all solar energy systems qualify for tax credits. To be eligible, the system must meet specific criteria, including:

- New Installations: The solar energy system must be a new installation. Upgrades to existing systems do not qualify.

- Compliance with Standards: The system must meet applicable fire and electrical code requirements.

- Use of Approved Equipment: The equipment used in the installation must be approved by the appropriate regulatory bodies.

Timing of Installation

To claim solar energy tax credits, the installation must be completed within the specified time frame. For the federal ITC, the system must be installed and operational by the end of the tax year for which you are claiming the credit. State and local incentives may have different deadlines, so it’s crucial to be aware of these dates.

Calculating Solar Energy Tax Credits

Understanding how to calculate your solar energy tax credits is essential for maximizing your savings. The amount of the credit depends on several factors, including the cost of the system and the applicable percentage rate.

Federal ITC Calculation

The federal ITC allows you to deduct 26% of the cost of installing a solar energy system from your federal taxes. For example, if your solar installation costs $20,000, you can claim a tax credit of $5,200 (26% of $20,000). This credit can be applied to your federal income tax liability, reducing the amount you owe.

State and Local Incentives

State and local solar energy tax credits vary widely. Some states offer flat-rate credits, while others provide a percentage of the system’s cost. For example, New York offers a tax credit of 25% of the cost of the system, up to a maximum of $5,000. It’s important to check the specific incentives available in your area and calculate your potential savings accordingly.

Combining Federal and State Credits

One of the significant advantages of solar energy tax credits is that you can combine federal and state incentives. By stacking these credits, you can substantially reduce the overall cost of your solar installation. For instance, if your state offers a 25% tax credit and you also qualify for the 26% federal ITC, you could potentially reduce the cost of your system by more than half.

How to Claim Solar Energy Tax Credits

Claiming solar energy tax credits involves several steps, including documentation, tax forms, and accurate record-keeping. Following these steps ensures that you can successfully claim your credits and maximize your savings.

Documentation and Record-Keeping

Maintaining thorough documentation is crucial when claiming solar energy tax credits. This includes:

- Receipts and Invoices: Keep all receipts and invoices related to the purchase and installation of your solar energy system.

- Certification: Ensure that you have certification documents proving that your system meets the required standards.

- Proof of Payment: Retain proof of payment, such as bank statements or credit card records, to verify that you have paid for the system.

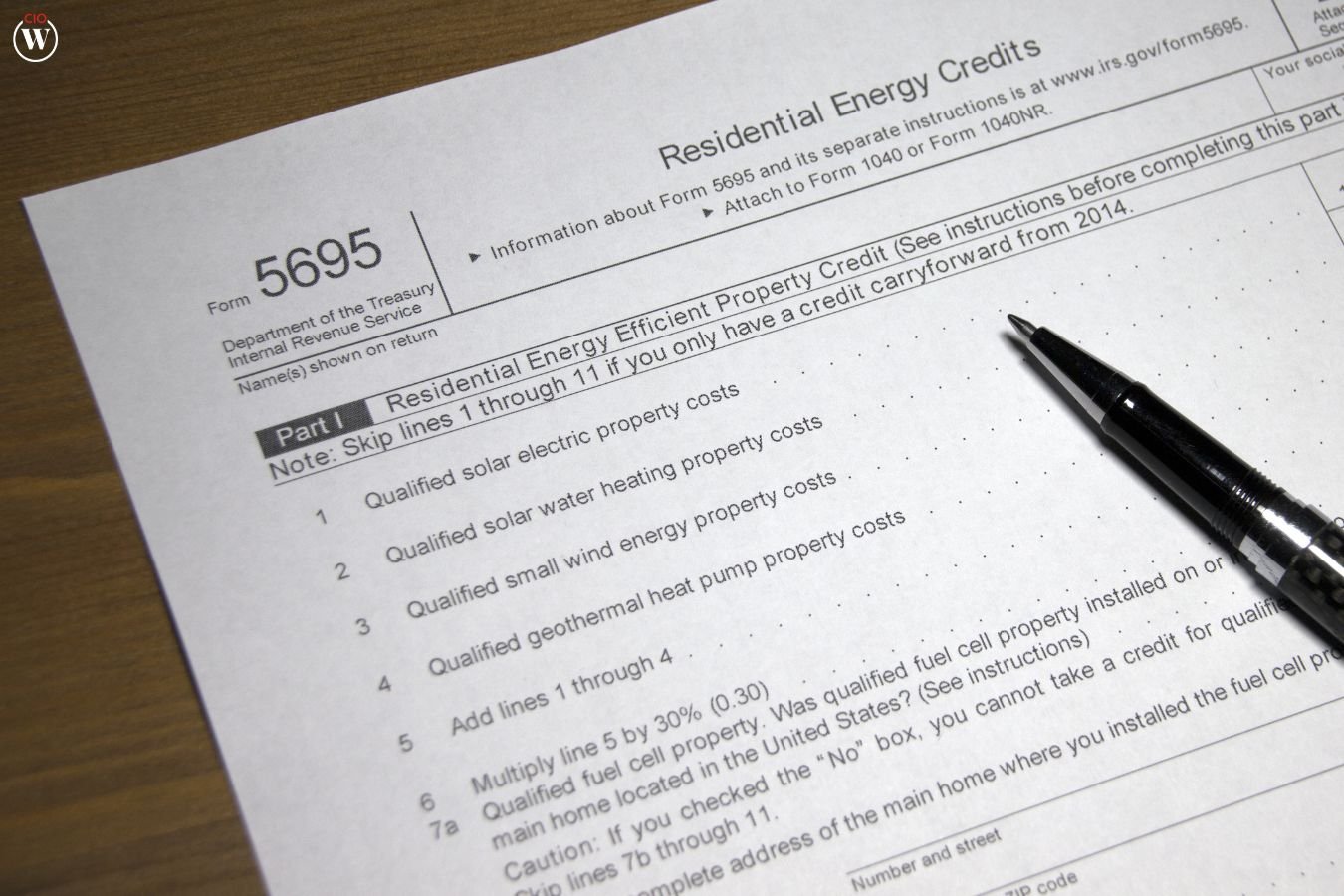

Tax Forms and Filing

To claim the federal ITC, you will need to complete IRS Form 5695, “Residential Energy Credits.” This form calculates your credit and is then included with your federal tax return. For state and local incentives, you may need to complete additional forms specific to your location. Consult with a tax professional to ensure that you are filing the correct forms and maximizing your credits.

Timing and Deadlines

Be mindful of the timing and deadlines associated with claiming solar energy tax credits. The federal ITC must be claimed in the tax year in which the system is installed and operational. State and local incentives may have different deadlines, so it’s essential to be aware of these and file your claims accordingly.

Maximizing Your Savings

Maximizing your savings through solar energy tax credits involves strategic planning and careful consideration of various factors. Here are some tips to help you make the most of these incentives:

Plan Your Installation Timing

Given that the federal ITC percentage is scheduled to decrease in the coming years, it’s wise to plan your installation sooner rather than later. By installing your solar energy system while the credit is still at 26%, you can maximize your savings.

Research State and Local Incentives

State and local incentives can significantly impact the overall cost of your solar installation. Research the specific credits and rebates available in your area and factor these into your decision-making process. Some states offer generous incentives that, when combined with the federal ITC, can make solar energy an incredibly cost-effective option.

Consult with a Tax Professional

Navigating the complexities of solar energy tax credits can be challenging. Consulting with a tax professional can help ensure that you are claiming all available credits and maximizing your savings. A tax professional can also guide the documentation and forms required, making the process smoother and more efficient.

Monitor Legislative Changes

Solar energy tax credits are subject to legislative changes. Stay informed about any updates or changes to federal, state, and local incentives. This knowledge allows you to adjust your plans accordingly and take advantage of any new opportunities that may arise.

Conclusion

Solar energy tax credits help lower the cost of installing solar panels for homeowners and businesses. By knowing who qualifies, calculating your credits correctly, and following the steps to claim them, you can save money and support a greener future. Since the federal ITC will decrease soon, now is the best time to invest in solar energy and get the most out of these financial incentives. Use solar energy tax credits to benefit your finances and the environment.